Or why every other online payment method sucks

The introduction of a new technology commonly comes with a great amount of scepticism. Companies rarely want to change their practice if the old method is still working. Conservatism is often the reason behind this. Change can be scary and risky; however, it’s important to see when the benefits justify the new operation mode transition.

Bitcoin is one of those examples, where new technology is far more superior, but it’s still embraced only by a relatively small number of operators. Perhaps the reason for such lazy adaptation is that the Bitcoin changes such a fundamental tool people have used to hundreds of years — money. Bitcoin is not only the new payment gateway system or online wallet, as many still falsely assume. It is new money.

Let’s compare current online payment gateway options and see why every merchant should start accepting Bitcoin.

What type of online payment options are available currently?

- Online wallets: PayPal, Neteller, Skill, etc.

- Card payments: Visa, Mastercard, etc.

- Bank transfer: direct or via 3rd party

And how are they? Well, honestly they all suck, for these reasons.

You don’t control your money.

When you use banks, credit card companies or online wallet providers, you don’t control your money. They physically hold your funds and can legally do things with them that are not in your best interest. One of these things is freezing your account or just withholding your funds.

This may not happen often, but when it does, the damage is huge. When you have millions stuck in your account for months, it can literally bankrupt the whole company. This happens every day to some unfortunate businesses.

The reason for such a tragedy can often be minor. Maybe someone sued your company, or there was some suspicion in money laundering, and the financial institution or the government just overreacted. There’s always a risk something like that happening even if you didn’t do anything wrong.

Bureaucracy

For things in the previous point not to happen, when dealing with financial institutions, you have to comply with their bureaucracy, and it’s exhausting. There are entire teams whose only job is to monitor that clients to go through painful KYC and AML procedures, because if they don’t, even if one dollar of “criminal” or “illegal” money slips by, it will be just another excuse for a financial institution to lock your account.

Imagine how much money merchants spend per year for complying with all the regulations set by the government?

High transaction fees

Credit card companies take on average 3% fee. Same applies for all online wallets that use card payments. With non-card payments, online wallets may take “only” 1–2%. In some countries, such as in EU bank transfer may be cheap, but it costs $25 per transfer on average in the USA.

That’s quite a lot. Imagine if your business makes $10M in revenue per year, 3% from that is $300k per year. That’s just huge!

Payment limits

Most cards have a payment limit per day or month. Usually, it’s a few thousand per day and tens of thousands per month. Even if you have more money on the account, it’s still impossible to surpass those limits if the bank has set them.

This means that if you are selling expensive goods, it may be quite hard for some customers to purchase them even if they want to.

Charge-backs

Whenever someone says charge-back, merchants go into a panic. Charge-back basically allows the consumer to dispute the payment, even if everything went by the book. Even if they fail in getting back the money, it’s still extra work the merchant and he also and up paying the charge-back fee anyway, even if he won. I’m sure everyone knows someone who does a charge-back even if they got what they paid for. There’s even a name for that — “friendly fraud”.

Country Restriction

Commonly, payment providers restrict specific countries. Usually, it’s the USA, China, Russia, or some 3rd world countries. That’s practically half of the world! How is one supposed to grow his business if he can’t accept payments from every other client? He will be forced to set up multiple payment gateways for different geographical regions? This will only raise the risk of getting his funds getting stuck somewhere along the way.

Solution

When you look at these problems, you will see that there’s actually quite a good reason for switching to Bitcoin, because with Bitcoin those problems do not exist.

Bitcoin is

- CHEAP: the average price of transactions is just $0,10-$1. Even if you send 1 million.

- FAST: Transactions get registered in blockchain usually within a few minutes. If you integrate your system with a specific wallet provider or use Lightning Network, it will take a few seconds.

- SECURE: No one but you has access to your funds. The money goes directly to your wallet, and no one can touch it.

- EASY: There’s no bureaucracy, no KYC/AML and no stupid question. You can start accepting Bitcoin payments right away and set up everything in 1 hour.

- And most importantly: It’s DECENTRALIZED. Everyone from any part of the world can send money to anyone they want. No one can come in between and stop them. That’s the definition of freedom.

By accepting Bitcoin, you are not just using a superior way of sending and receiving money; you are taking back your financial freedom. Therefore, there’s really no place to argue if you should do that or not.

Though there is one more reason, many of you have not thought about.

When you accept Bitcoin payment and hold to those Bitcoins after getting them, you most likely will earn a profit, due to a price increase.

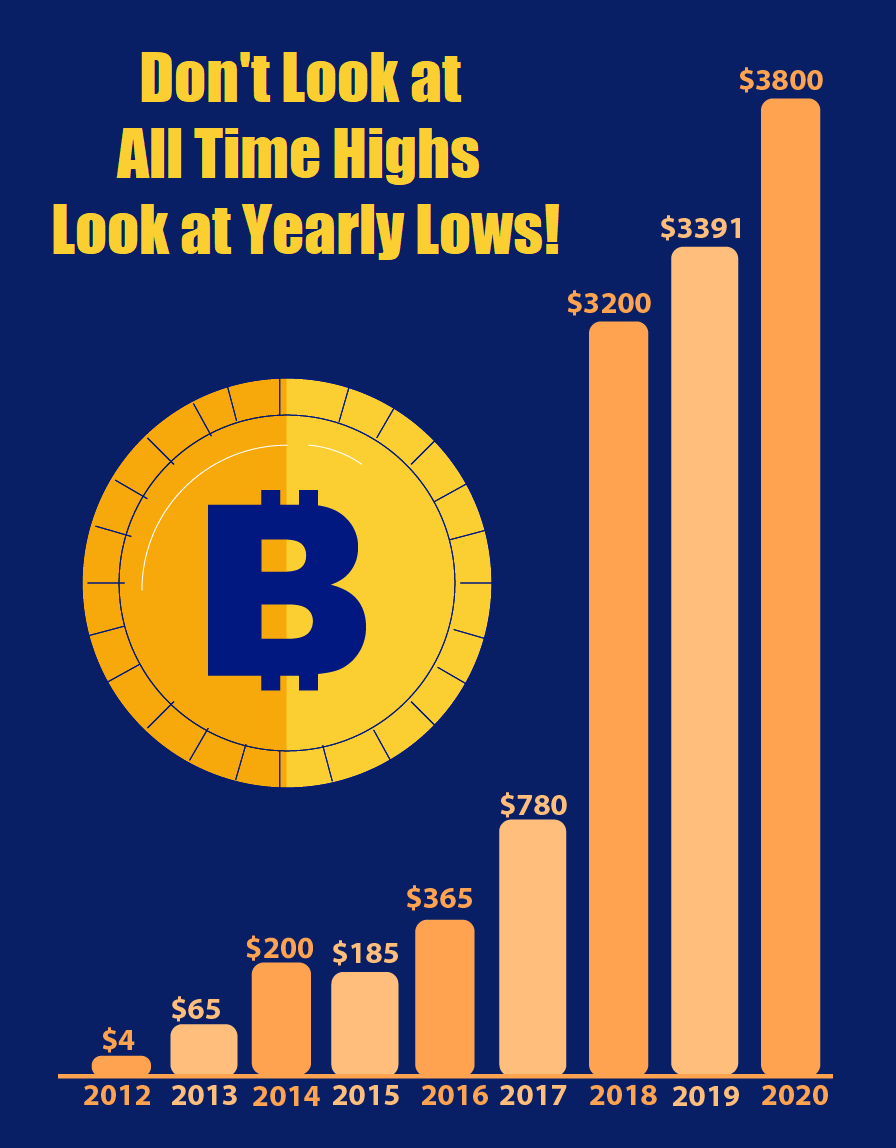

I’m sure you have heard about all sort of bubble and Bitcoin price going up and down, but that’s just short term. If you look long term, you can see that despite all ups and downs, the price of Bitcoin has been systematically growing.

So, if you put your money in Bitcoin today, you will most likely have profit in the future. Even if a huge price increase like in the past will not happen again, you will still get a better ROI than with any other investment out there.